Government actions

Markstrat government will regularly intervene during the simulation, as they are more and more concerned by ecological stakes and encouraged by lobbies to give a clear setting for manufacturers in terms of ecological efforts to be made. Two types of intervention are considered as plausible during the simulation:

-

Eco-taxes specific to circular characteristics of your products. A tax may be applied to companies that are not circular enough on specific characteristics of their products. For instance, a company producing a product whose Percentage of Recyclable Materials is under a given threshold may be taxed at some point; on the opposite, a company producing a product whose carbon footprint is above a given threshold may be taxed. The tax will be applied for each unit sold. We know that the government will announce taxes before they are applied (probably two periods before), so that companies can launch R&D projects to adapt their products if they want to avoid being taxed.

-

Eco-bonus or Eco-malus (at the company level). Experts believe that it is very likely that the Markstrat government gives companies exceptional grants (eco-bonus) for making sustainable achievements or having improved their sustainable approach. Experts also believe that the government will charge companies that do not make sustainable achievements (or low ones) with exceptional taxes (eco-malus). The indicator that the Markstrat government will use to assess achievements is your company eco-score, as it is calculated by an external institution acknowledged by the government. The government is not likely to announce eco-bonus/eco-malus, so each company needs to pay attention to the level of its eco-score. Improving a company eco-score may be done (i) either by making your product physical characteristics more environmentally friendly (i.e. increasing your product repairability) or (ii) by implementing circular initiatives.

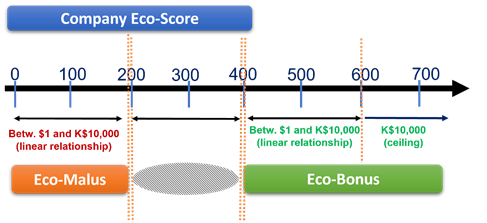

Eco-bonus and eco-malus are defined by your professor. By default, Figure 2 gives some estimation:

-

If the company eco-score is between 400 and 600: eco-bonus between $1 and K$10,000, following a linear relationship (an eco-score of 500 will lead to an eco-bonus of $K5,000). K$10,000 is the maximum (ceiling) eco-bonus that can be obtained (even if the company eco-score is > 600).

-

If the company eco-score is between 200 and 399: no eco-bonus.

-

If the company eco-score is between 0 and 199: eco-malus between $1 and K$10,000, following a linear relationship (a eco-score of 100 will lead to an eco-bonus of $K5,000). K$10,000 is the maximum eco-malus that can be obtained.

Figure 2 – Company Eco-Score

All companies should thus carefully check government messages in their report and check their eco-score to anticipate potential government actions (see section IV.1.B).

-